The Essential Guide to Building a Home in Australia as a Foreign Investor

Discover the secrets to hassle-free

home planning and craft your

dream home with confidence,

one step at a time.

Building a home in Australia as a foreigner is an exciting yet complex endeavor, especially with new laws set to take effect in 2025. Whether you’re dreaming of a custom-designed family home or an investment property, navigating the process requires careful planning, an understanding of legal requirements, and the right partnerships.

As the owner of a business that specializes in helping Australians plan their new homes and achieve optimal outcomes with trusted builders, I’m here to guide you through the process, spotlighting how my expertise can streamline your journey while addressing Australia’s evolving regulations.

Ready to enquire about our currently available home and land packs? Visit our dedicated site and make an enquiry now.

Why Build a Home in Australia as a Foreigner?

Australia’s appeal for property investment is undeniable: a stable economy, growing population, and a lifestyle that ranks among the world’s best. For foreign investors, building a new home, especially via our streamlined home-and-land package options, offers a practical way to tap into this market.

Unlike buying existing homes (banned for foreigners from April 2025), constructing a new dwelling aligns with Australia’s push to boost housing supply, making it both legal and potentially lucrative. Whether you’re eyeing capital growth or rental income, this guide explains the essentials and how I can support you.

Can Foreigners Build Homes in Australia?

Yes, you can build a home in Australia as a foreigner, but there are strict rules to follow. The Australian government oversees foreign property investment through the Foreign Investment Review Board (FIRB), which ensures your project adds to the housing stock. Here’s what that means for you:

New Builds Only: From April 2025, foreigners can’t buy established homes (until at least March 2027). You’re limited to new dwellings or vacant land you develop within 4 years.

FIRB Approval Required: Before buying land or a package, you need FIRB permission. This involves submitting your identity, finances, and build plans – more on that below.

That’s where my Global Gateway division at Foresight Home Planning steps in—we guide foreigners through securing a suitable block, home design, trusted builders, and the FIRB process, streamlining your journey to owning a new Australian property.

Additional Costs for Foreign Investors

At Foresight Home Planning, we’ve researched state-by-state costs—comparing upfront fees at purchase and ongoing land taxes—to pinpoint the best investment options for foreigners. Our conclusion? Western Australia stands out for better cash flow, thanks to its lack of an annual land tax surcharge, unlike other states that impose hefty yearly fees cutting into your returns. Here’s the breakdown:

Stamp Duty and Additional Fees

Foreigners purchasing home-and-land packages typically pay standard stamp duty on the land value, with additional surcharges in states like NSW, VIC, QLD, SA, WA, and TAS. For example, NSW and VIC both add an 8% surcharge, while SA, WA, and QLD add 7% to 8%. The ACT has no stamp duty, and NT has no additional surcharge, meaning foreigners pay the standard rate there. These surcharges can significantly increase initial costs, so it’s important to budget accordingly.

Land Tax and Ongoing Costs

Beyond purchase, foreigners face annual land tax surcharges in states like NSW (4%), VIC (4%), QLD (3% above $350,000), TAS (2%), and ACT (a0.75%), but not in SA, WA, or NT, where there’s no additional charge. These annual costs can affect long-term ownership, so consider them when planning.

While stamp duty hits once at purchase, it’s the ongoing land tax—like $12k-$16k yearly on a $400k block in NSW, VIC, or QLD—that dents your rental income most. Add vacancy fees ($7k+ for a $1M property empty over 6 months) across all states, and WA’s zero land tax surcharge makes it our prime choice for foreigners seeking profit over headaches.

How to Build Your Australian Home: Key Steps

Navigating the process to build in Australia can feel daunting, but it’s manageable with the right approach. Below are the essential steps to get you from idea to completion, with my team at Foresight Home Planning ready to guide you where we can.

Step 1: Confirm Your Eligibility

First, ensure you qualify. Non-residents and temporary residents (with visas over 12 months) can build new homes, but the 2025 ban on existing homes applies to both. Your focus must be on new construction—like a home-and-land package—that meets FIRB rules and boosts Australia’s housing supply.

Step 2: Pick a Home-and-Land Package

Before applying to FIRB, find your property. Home-and-land packages in Western Australia are ideal – affordable, growth-focused, and free of annual land tax surcharges that burden states like QLD or NSW. At the time of writing this article we currently have a couple examples available like a 3-bedroom narrow lot at $596,990 or a 4-bedroom wider lot at $719,990.

If these sound like suitable options, we can then source similar options that are available now, all we need from you is verification that you have finances ready and a copy of your passport.

If not, we also reach out to our network of land developers to source a block of land anywhere in WA for you, and we can also source builders to build any type of home you are thinking of so please do not feel restricted by the examples listed above.

Step 3: Apply for FIRB Approval

FIRB approval is your next hurdle. You (or your lawyer) must apply, submitting your ID, finances, and property details from Step 2. I can’t file for you, but I’ll guide you with:

- A clear rundown of the process.

- Tips on gathering documents.

- Links to trusted legal professionals if needed.

It takes 30-60 days and costs $14,700 for a $1M property (fees scale up). Skipping this risks fines up to $157,500 – don’t chance it.

Step 4: Arrange Financing

Australian banks often cap loans at 60-75% of the property value for foreigners, meaning a 25-40% deposit. Some have tightened lending since 2025, but I can link you with lenders or non-bank options tailored to your needs.

Step 5: Build and Stay Compliant

Start construction within 24 months of FIRB approval and finish within 4 years. You’ll need to report progress and submit completion evidence (e.g. occupancy certificates) within 30 days of finishing. Miss these deadlines, and you could face penalties.

Why Choose Home-and-Land Packages in WA?

Home-and-land packages are a foreign investor’s secret weapon in Australia. They simplify the process and offer big rewards, especially in Western Australia. Here’s why they’re ideal:

Simplified FIRB Approval

These packages are pre-designed to add housing, aligning with FIRB goals. This makes your application smoother and faster—less guesswork, more certainty.

High Growth Potential

WA’s Perth suburbs are booming—population’s estimated to hit 3.5 million by 2050, with mining and infrastructure potentially driving demand for strong capital gains and returns.

Affordable and Customizable

Compared to Sydney or Melbourne, QLD and WA offer lower entry prices without sacrificing quality. Plus, you can tweak designs with my partnered builders to suit your vision—think energy-efficient features or layouts for renters.

Common Mistakes to Avoid

Even with a solid plan, pitfalls can trip you up. Here’s what to watch for:

- Skipping FIRB: Buying without approval is illegal and costly – don’t risk it.

- Land Banking: Holding land without building violates rules and triggers scrutiny.

- Underestimating Costs: Budget for stamp duty surcharges and a hefty deposit.

I’ve seen these snags derail investors – let me help you sidestep them.

How Foresight Home Planning Simplifies It All

Building in Australia as a foreigner doesn’t have to be a solo slog. At Foresight Home Planning, I bring years of experience and ties with top WA builders to the table. Here’s how I support you:

- FIRB Guidance: I’ll walk you through prep, though you’ll file the application (or your lawyer will).

- Exclusive Packages: Get first dibs on prime home-and-land deals.

- Full Journey Support: From financing to completion, I’ve got your back.

Why go it alone when you can have an expert partner?

Ready to Build? Let’s Talk

The rules are strict, but the rewards are worth it. With my help, you can secure a home-and-land package in Western Australia—free of annual land tax surcharges—and navigate the FIRB maze with confidence. Don’t wait—reach out today for a tailored plan.

FAQs About Building in Australia as a Foreigner

Can I Buy an Existing Home?

No, a ban from April 2025 to March 2027 limits you to new builds only.

How Long Does FIRB Approval Take?

Typically 30-60 days – faster with proper prep, which I can assist with.

What Happens If I Don’t Use My Property for 6 Months?

Properties left vacant for extended periods trigger specific obligations under Australian foreign investment laws. The Annual Vacancy Fee represents a significant consideration for foreign property owners who leave their properties unoccupied for more than six months in a calendar year.

When a property remains vacant for more than six months, several consequences follow:

The owner must pay an annual vacancy fee approximately equal to the foreign investment application fee paid during the property’s purchase The vacancy must be reported through the ATO’s vacancy fee return system Documentation proving any periods of occupancy must be maintained Failure to report or pay vacancy fees can result in significant penalties

Understanding what constitutes “occupation” proves crucial. The property must be genuinely occupied as a residence, either by tenants or the owner. Simply maintaining utilities or occasional visits does not satisfy the occupancy requirement.

Can Temporary Residents Buy Investment Properties?

Temporary residents in Australia face new restrictions on property purchases as of April 2025. While they previously enjoyed broader property rights compared to non-resident foreign investors, the regulatory landscape has changed significantly with the introduction of the two-year ban on established home purchases.

From April 1, 2025, temporary residents holding valid visas for more than 12 months may only invest in new properties or off-the-plan developments. This represents a substantial change from previous rules that allowed the purchase of established homes as principal residences. The government has implemented this temporary restriction as part of broader efforts to address housing affordability challenges in Australia.

Temporary residents must still obtain FIRB approval before proceeding with any property purchase. Their investment opportunities now focus primarily on new developments, including:

- Off-the-plan apartment purchases

- Newly constructed homes that have never been occupied

- Participation in certain development projects that increase housing supply

These investments carry specific obligations, including maintaining compliance with development conditions and meeting FIRB reporting requirements. The government has also strengthened compliance monitoring, with enhanced oversight from the Australian Taxation Office’s foreign investment compliance team.

Limited exceptions to these restrictions exist, particularly for participants in the Pacific Australia Labour Mobility (PALM) scheme. These exceptions recognize the scheme’s importance in supporting Australia’s workforce needs while maintaining strong bilateral relationships with Pacific nations.

What is FIRB?

FIRB stands for the Foreign Investment Review Board, Australia’s body that oversees property purchases by foreigners. It ensures your investment—like building a new home in Western Australia—adds to the housing supply, requiring approval before you buy land or a package. At Foresight Home Planning, I guide you through the FIRB process, making it smooth and stress-free.

Are There Exemptions to FIRB Rules?

While FIRB rules generally apply broadly to foreign property investment, certain exemptions exist. Understanding these exemptions helps investors identify opportunities that might suit their specific circumstances.

Current exemptions include:

- Purchases by Australian citizens living abroad

- Acquisitions by New Zealand citizens

- Properties bought by permanent resident visa holders

- Joint purchases with Australian citizen spouses

- Certain inherited properties

- Specific corporate restructuring scenarios

Each exemption carries its own conditions and requirements. Professional advice often proves essential in determining whether a particular exemption applies to your situation.

What Are the Hidden Costs of Buying Property in Australia?

Beyond the purchase price, foreign investors must account for various additional costs when buying Australian property. Understanding these costs helps create more accurate investment budgets and prevents unexpected financial surprises.

The complete cost structure typically includes:

- Foreign investment application fees paid to FIRB

- State-based stamp duty and foreign investor surcharges

- Vacancy fees if the property is vacant for 183 days or more

- Legal and conveyancing fees for property transfer

- Property inspection and valuation costs

- Loan establishment fees and ongoing mortgage costs

- Council rates and utility connection fees

- Property management fees for rental properties

- Insurance premiums for building and landlord coverage

- Annual land tax and other ongoing property taxes

- Maintenance and repair provisions

The cumulative impact of these costs can significantly affect investment returns. Professional financial advice helps ensure all costs are properly accounted for in investment planning.

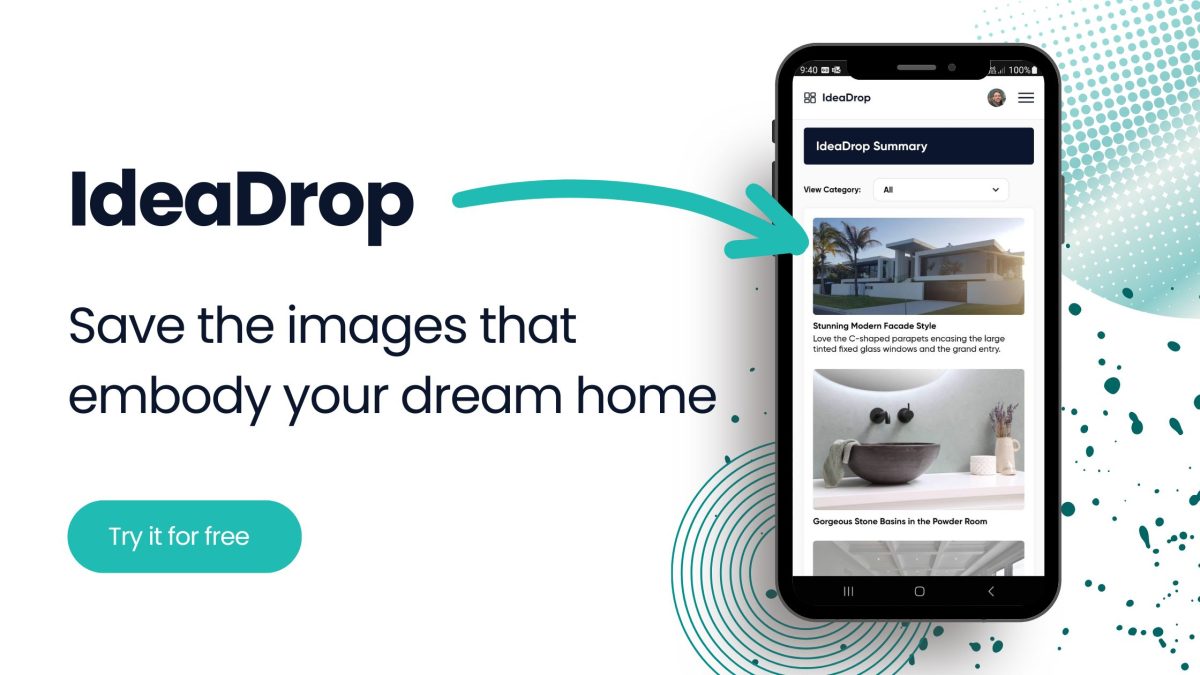

Where Are You Saving Your New Home Inspo?

Looking for a place to organize and store the growing collection of notes and ideas that you have for your new home?

We got you.

Back when I was planning my first home I had the same problem, notes everywhere with no structure to keep track of them.

I was using Evernote, Excel, sheets of paper in my office and to-do list apps, but then I realised something, if I’m facing this problem then surely many others must be also. So I set out to build an online home planning service where you can create a vision for the new home you’re planning by storing all of your notes and inspiration in one easy-to-access place.

To achieve this I’ve developed a tool named IdeaDrop, which is available at no cost through this website.

It allows you to conveniently store all your notes and inspirational images for your new home in one conveniently categorised place. This way, everything is organized and easily accessible when it’s time to start discussions with your builder, ensuring all your ideas are neatly compiled and ready to go.

Curious to learn more about IdeaDrop?

This article digs into what it is and how it can help you visualise your dream home.

**Disclaimer: The information provided in this article is based on publicly available information. While we strive to ensure the accuracy of this content, Foresight Home Planning Pty Ltd does not guarantee the completeness or reliability of the information. This article is intended for entertainment purposes only and does not constitute professional advice. Foresight Home Planning does not accept liability for any loss, expenses or damage incurred as a result of reliance on the information contained herein. Readers are advised to conduct their own research and seek professional advice & legal advice before making any decisions related to property purchases, contracts with builders or investments.

*1: Terms and conditions apply. Registered users of our service must complete our HomeVision program and subsequently join our BuilderConnect program to be eligible for Foresight Home Planning to find you a builder in your local area.