Queensland’s Builder Failures Cost Homeowners Record $88.7 Million in 2024

Discover the secrets to hassle-free

home planning and craft your

dream home with confidence,

one step at a time.

The Hidden Cost of Builder Failures Leaves Queensland Homeowners Reeling

When Sarah and Tom Mitchell signed their contract to build their first home in Brisbane’s northern suburbs in early 2023, they never imagined they’d become part of Queensland’s largest-ever wave of construction industry insurance claims. Six months into their build, their builder went into liquidation, leaving them with an unfinished home and mounting costs.

“We thought we’d done everything right,” says Sarah. “We checked their license, read reviews, even called previous clients. But none of that mattered when they went under.”

The Mitchells are not alone. New data from the Queensland Building and Construction Commission (QBCC) reveals an unprecedented $88.7 million in insurance claims approved during 2023-2024, marking a staggering 140% increase in claim values over the past decade.

Don’t let this happen to you!

Tell us about your building plans, and let us help you choose the right builder.

We support you throughout the entire process from deciding what to build, who to build with, all the way to handover. The support the industry needs has finally arrived.

Record-Breaking Year for Builder Collapses

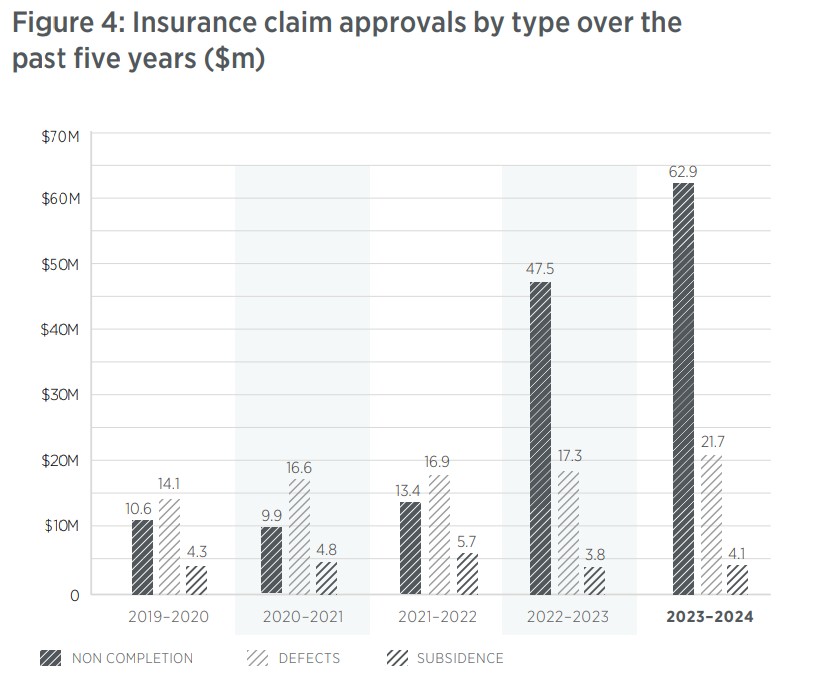

The QBCC’s latest annual report paints a sobering picture of the construction industry’s challenges. Of the total claims approved:

- $62.9 million was for non-completion claims

- $21.7 million covered defects

- $4.1 million addressed subsidence issues

These figures represent the highest payout in the scheme’s history. What’s particularly concerning is the proportion of non-completion claims, which signals a significant increase in builder insolvencies.

Notably, while the QBCC reports receiving 2,299 claims during 2023-2024, they do not disclose the total dollar value of claims submitted. This lack of transparency makes it impossible to determine what percentage of claimed amounts are actually paid out to homeowners. For instance, a homeowner might claim $400,000 in losses but receive substantially less, and this disparity isn’t captured in the public reporting. This gap in the data raises questions about the true scale of financial losses homeowners are facing when builders fail.

The Recovery Challenge

Perhaps most alarming is the recovery rate for these claims. Of the $88.7 million paid out, the QBCC managed to recover just $3.9 million from failed builders – a recovery rate of only 4.4%. This leaves the insurance scheme absorbing over $84.8 million in unrecoverable losses.

When we’re seeing recovery rates this low, it indicates many of these builders had no assets left when they failed. This raises serious questions about financial oversight in the industry and leads me to believe that more stringent measures need to be implemented to ensure builders have the financial means to complete the work they take on.

Now it’s all well and good to say something should be better but how might we actually improve this situation with actionable methods?

Practical Solutions to Protect Homeowners

Having worked extensively in the industry, I see several practical solutions that could better protect homeowners while maintaining a viable construction sector:

- Progressive Financial Health Checks: Rather than just annual reviews, the QBCC could implement half yearly financial health assessments for builders based on their active contract values. This would help identify potential issues before they become critical.

- Early Warning System: Implementing mandatory reporting of key financial indicators like payment delays to suppliers or subcontractors could serve as early warning signs of potential financial stress.

- Mandatory Estimating Training: My experience has shown that many builders excel at construction but struggle with estimating and pricing their projects. Enhancing the importance of estimating education for licensing could help prevent financial mismanagement.

The key is finding solutions that protect homeowners while allowing legitimate builders to operate efficiently, without implementing guidelines or rules that give one builder an advantage over another. These measures could help prevent builder failures without creating overly burdensome restrictions on the industry.

Rising Claims Lead to Stricter Interpretation of Insurance Coverage

As insurance payouts reach historic highs, industry insiders note a concerning trend in how claims are being assessed. The QBCC, facing mounting pressure from the $84.8 million in unrecoverable losses, has adopted increasingly strict interpretations of their governing legislation when assessing claims.

We’re seeing more technical grounds being used to deny legitimate claims. The interpretation of what constitutes contract termination has become particularly contentious.

A recent case in Brisbane highlights this troubling pattern. Despite seeking QBCC mediation after paying their builder who demanded extra funds and refused to complete the works, a homeowner had their claim denied on grounds of ‘mutual abandonment.’ Even more concerning, the QBCC used the homeowner’s inquiries about proper termination procedures as evidence of contract repudiation.

This case exemplifies a broader shift in claim assessment patterns. As claim volumes and values continue to surge, the QBCC appears to be looking more closely at technical grounds for denial. We suspect this trend correlates directly with the increasing financial pressure on the insurance scheme.

Protecting Your Right to Claim

For homeowners, these developments underscore the critical importance of understanding your rights and following proper procedures when dealing with builder disputes. Seemingly innocent actions, such as discussing termination options with the QBCC, can later be used as grounds for claim denial.

Regulatory Response

The QBCC has responded with increased scrutiny of builder finances, conducting 350 financial audits in the past year. Their enforcement actions included:

- 222 notices for proposed license suspensions

- 128 actual license suspensions

- 44 license cancellations

- 263 individuals excluded from holding licenses due to financial failures

However, in the larger picture is this really enough? Time will most certainly tell, though I would really love to see broad action applied to all builders.

Protection Through Prevention

For those planning to build, these findings underscore the importance of thorough due diligence and professional guidance. At Foresight Home Planning, we’ve seen firsthand how proper planning and builder selection can help avoid becoming part of these statistics. If you’d like a second opinion about a builder you’re currently considering or help sourcing a great builder in your local area, please feel free to reach out.

Planning Your New Home: Why It’s Crucial Before Approaching a Builder

Embarking on the quest for the ideal home builder in Queensland can be quite the endeavor. If you’re wondering how to sift through the options and identify a builder with a skilled team, efficient building processes locked down, and provided at exceptional value, you’re in good company. This is a common challenge faced by many prospective homeowners.

What many don’t realize is that once you start discussions with builders, their main aim is often to get you to commit as quickly as possible. This rush can lead to stress, especially since it overlooks a critical aspect:

If you’d rather take a well-planned thorough approach, and are interested in developing a clear vision for your home before diving into conversations with builders, then we have the perfect solution for you at Foresight Home Planning.

Our passion lies in helping to craft extraordinary homes. In fact, there’s nothing quite like taking a wander through a freshly completed; exceptionally designed home, so once yours is complete, don’t forget to send the invite!

At Foresight Home Planning, we’re committed to empowering you with the tools and insights needed to plan and then construct a home beyond your wildest dreams. Let’s redefine the boundaries of home design together, and help raise the standard of the homes being built across this great country by adding a dash of character and a sprinkle of innovation, ensuring each home not only reflects your unique personality and lifestyle aspirations but also invites you into the future of sustainable and intelligent living.

Through our HomeVision program and with the assistance of our IdeaDrop web app, you can shape and refine your home concept gradually until it reaches a point where you know it’s ready to come to life. With this vision, we’ll assist you in finding the ideal builder to actualize your dream home no matter where you want to build on the Sunshine Coast, surrounding suburbs, or Queensland as a whole.

Our love for homes drives us at Foresight Home Planning. We’re devoted not just to ensuring you have an unforgettable experience but also to maintaining the highest standards. Witnessing the emergence of cutting-edge trends and unique designs in homes meticulously planned by their owners is our reward.

With our HomeVision program, rest assured that complete customer satisfaction is always included as standard.

Hit the learn more button below to see how we do it.

Where Are You Saving Your New Home Inspo?

Looking for a place to organize and store the growing collection of notes and ideas that you have for your new home?

We got you.

Back when I was planning my first home I had the same problem, notes everywhere with no structure to keep track of them.

I was using Evernote, Excel, sheets of paper in my office and to-do list apps, but then I realised something, if I’m facing this problem then surely many others must be also. So I set out to build an online home planning service where you can create a vision for the new home you’re planning by storing all of your notes and inspiration in one easy-to-access place.

To achieve this I’ve developed a tool named IdeaDrop, which is available at no cost through this website.

It allows you to conveniently store all your notes and inspirational images for your new home in one conveniently categorised place. This way, everything is organized and easily accessible when it’s time to start discussions with your builder, ensuring all your ideas are neatly compiled and ready to go.

Curious to learn more about IdeaDrop?

This article digs into what it is and how it can help you visualise your dream home.

**Disclaimer: The information provided in this article is based on publicly available information. While we strive to ensure the accuracy of this content, Foresight Home Planning Pty Ltd does not guarantee the completeness or reliability of the information. This article is intended for entertainment purposes only and does not constitute professional advice. Foresight Home Planning does not accept liability for any loss, expenses or damage incurred as a result of reliance on the information contained herein. Readers are advised to conduct their own research and seek professional advice & legal advice before making any decisions related to property purchases, contracts with builders or investments.

Note: Names and personal details in this article have been changed to protect privacy.

*1: Terms and conditions apply. Registered users of our service must complete our HomeVision program and subsequently join our BuilderConnect program to be eligible for Foresight Home Planning to find you a builder in your local area.